Securities Borrowing and Lending Account Types

Conditions for Securities Borrowing and Lending

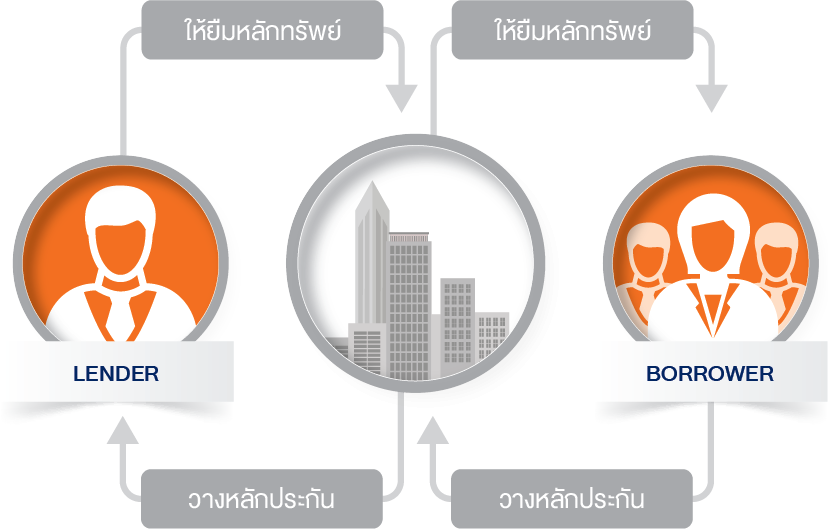

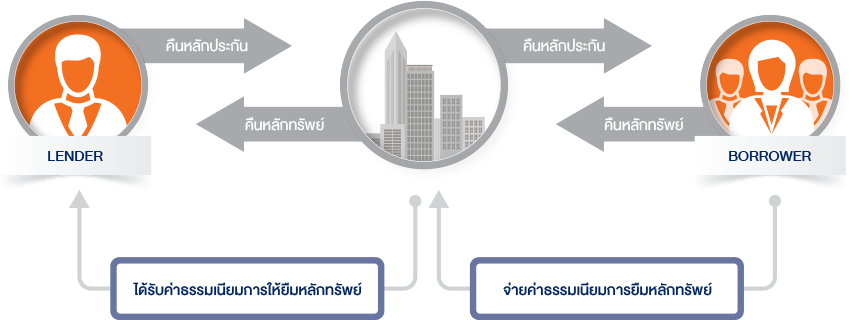

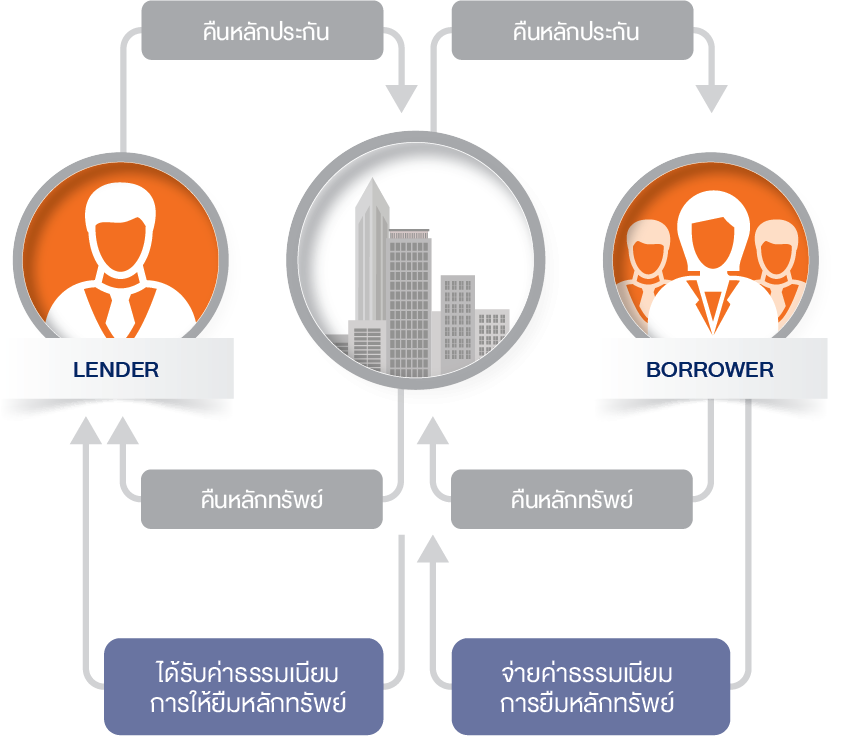

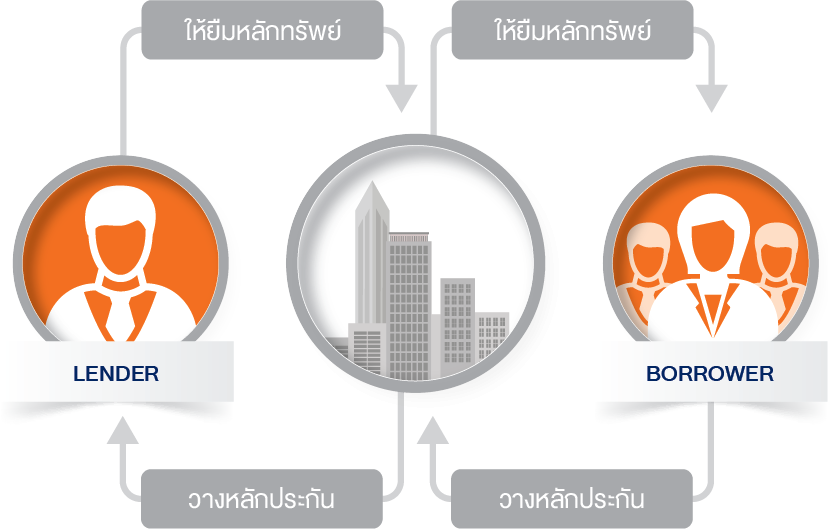

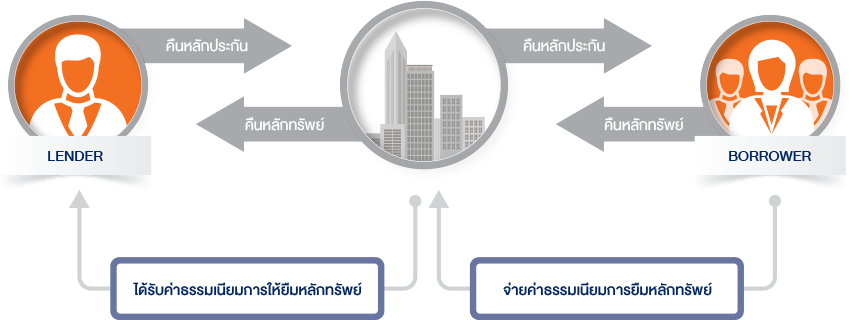

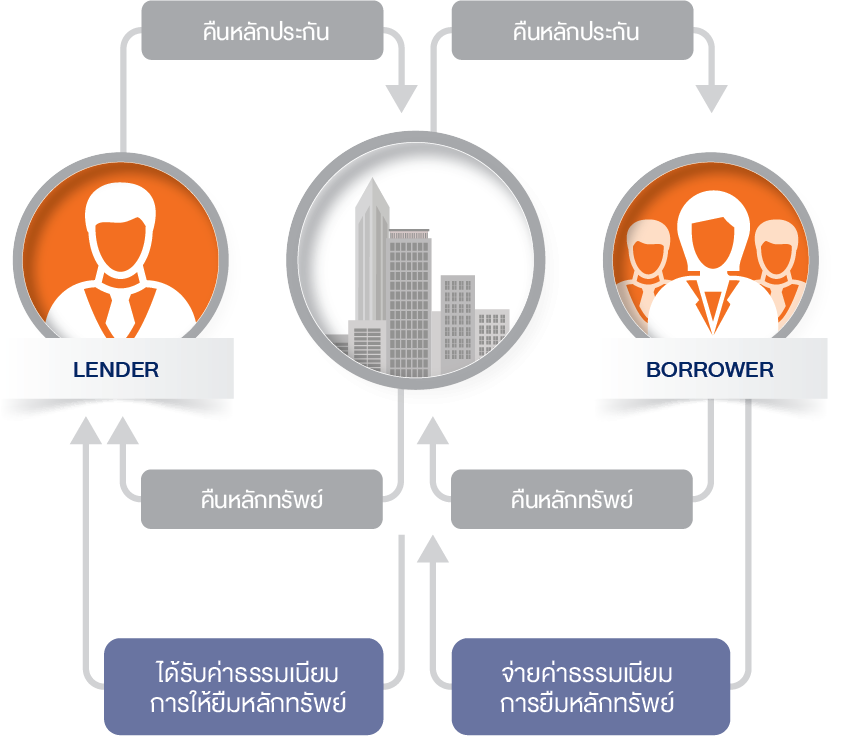

Finansia Syrus Securities Public Company Limited provides Securities Borrowing and Lending (SBL) services, offering investors enhanced options for risk management and profit strategies in declining market conditions. In this capacity, the company serves as an intermediary, acting as the principal party facilitating transactions between lenders and borrowers of securities.